How to get a tax deduction If the treatment was paid for by a family member Deadline for personal income tax refund Amount of deduction for dental treatment Reasons for refusing the deduction

According to general rules, tax deductions are provided to personal income tax payers at a rate of 13%. Pensions are not taxed, so retirees are not entitled to tax compensation unless they have other sources of taxable income.

Let's talk about how pensioners can compensate for the costs of dental treatment.

What is a tax deduction for treatment?

According to the legislation of the Russian Federation (Article 219 of the Tax Code of the Russian Federation), when paying for treatment or medications, you can count on a tax deduction and return part of the money spent on treatment .

A tax deduction is the portion of income that is not subject to tax. Therefore, you can return the tax paid on the expenses incurred for treatment. If you officially work and pay income tax, have paid for your treatment or the treatment of your relatives , you can get back part of the money in the amount of up to 13% of the cost of treatment .

Who will not be able to count on tax compensation?

In addition to non-residents and the unemployed, a tax deduction is not provided if treatment and medicines were paid for:

- pensioners who do not continue to work;

- parents for children over 18 years of age;

- an employer for his employee;

- a relative with a different degree of relationship than marital and parental relationships (for example, a grandson for a grandmother, etc.);

- an entrepreneur who is under one of the special taxation regimes that does not provide for the payment of income tax (STS, UTII).

ATTENTION! Also, you should not count on a deduction if during a given tax period you did not have income taxed at a rate of 13%, even if you incurred treatment expenses.

In what cases can you get a tax deduction for treatment?

You can take advantage of the social tax deduction for treatment and get part of your expenses back in the following cases:

- You can get a tax deduction when paying for medical services, If:

- paid for services for their own treatment or treatment of close relatives (spouse, parents, children under 18 years of age) provided by medical institutions in Russia;

- paid services are included in a special list of medical services for which a deduction is provided. The list of services is defined in Decree of the Government of the Russian Federation dated March 19, 2001 N 201.

- the treatment was carried out in a medical institution licensed to carry out medical activities;

- You can get a tax deduction when paying for medicines, If:

- paid at their own expense for medications for themselves or their immediate relatives (spouse, parents, children under 18 years of age) prescribed by the attending physician.

- You can get a tax deduction when paying for voluntary health insurance, If:

- paid insurance premiums under a voluntary health insurance agreement or insurance for immediate relatives (spouse, parents, children under 18 years of age);

- the insurance contract only provides for payment for treatment services;

- the insurance organization with which the voluntary insurance agreement has been concluded has a license to conduct the corresponding type of activity.

What part of the amount for treatment can a pensioner return?

The Tax Code establishes a citizen’s right to a deduction in the amount of expenses actually incurred for treatment and the purchase of medicines. However, the legislator sets the maximum amount of deduction per tax period.

Reference! In accordance with Art. 216 of the Tax Code, the period for calculating personal income tax is determined by the calendar year (for example, 2020).

The specified maximum amount is set at 120,000 rubles, but not only for treatment, but for almost all types of social deductions, namely:

- paying for your own training;

- contributions to non-state pension provision;

- additional contributions to funded pension;

- costs of undergoing an independent assessment of your qualifications.

This does not take into account the costs of educating children (deduction of no more than 50,000 rubles) and expensive medical services (deduction for which is provided based on actual costs incurred).

Do not forget that the indicated amounts are only deduction amounts, i.e. the amount of income that is not subject to income tax. Since the rate of this government fee is 13%, you can only claim a refund of 13% of the expenses incurred or the maximum established amount.

Amount of tax deduction for treatment

The amount of tax deduction for treatment is calculated for the calendar year and is determined by the following factors:

- You cannot return more money than you transferred to the income tax budget (about 13% of the official salary).

- You can return up to 13% of the cost of paid treatment/medicines , but not more than 15,600 rubles . This is due to the restriction on the maximum deduction amount of 120 thousand rubles (120 thousand rubles * 13% = 15,600 rubles). The limit of 15,600 rubles applies not only to deductions for treatment, but to all social deductions. The amount of all social deductions (training, treatment, pension contributions) should not exceed 120 thousand rubles. You can return a maximum of 15,600 rubles for all deductions).

- There is a certain list of expensive medical services to which the limit of 15,600 rubles does not apply . You can receive a tax deduction and get 13% back on the full cost of such services in addition to all other social deductions. The full list of expensive services is defined in Decree of the Government of the Russian Federation of March 19, 2001 N 201. You can find it here: List of expensive types of treatment

Example : In 2022, Ivanov A.A. paid for a course of dental treatment costing 140 thousand rubles and a paid operation related to expensive treatment costing 200 thousand rubles. At the same time, in 2022 he earned 500 thousand rubles and paid income tax of 62 thousand rubles.

Since dental treatment is not an expensive treatment, the maximum tax deduction for it is 120 thousand rubles (which is less than 140 thousand rubles). Since the operation of Ivanov A.A. refers to expensive types of treatment, there are no restrictions on tax deductions for it.

Total in 2022 for 2022 Ivanov A.A. will be able to return to himself (120 thousand rubles + 200 thousand rubles) * 13% = 41,600 rubles. So Ivanov A.A. paid taxes more than 41,600 rubles, he will be able to return the entire amount.

Additional and more complex examples of calculating a tax deduction for treatment can be found here: Examples of calculating a tax deduction for treatment

Tax deduction for treatment: what is the most profitable way to return taxes?

Article subheadings:

- Who is eligible for a refund?

- How to calculate tax refund for treatment

- What can you get a refund for?

- What is the most profitable way to return a refund to your family?

- Other deductions that are included in the social deduction

- What documents are needed?

- How to quickly and inexpensively apply for a treatment deduction

Who is eligible for a refund?

One of the tax deductions that can be provided to the taxpayer is the social tax deduction for treatment. This deduction allows the taxpayer to reduce income subject to personal income tax at a rate of 13% by the amount of expenses incurred in connection with treatment. You can return 13% of 120,000 rubles or more annually.

The following expenses of the taxpayer can be included in the deduction (clause 3, clause 1, article 219 of the Tax Code of the Russian Federation):

- medical services provided to himself, his spouse, parents, as well as children (including adopted children) and wards under the age of 18 (hereinafter referred to as family members);

- medications prescribed by a doctor, including for family members;

— insurance premiums under a VHI agreement concluded for the purpose of treatment of oneself or the treatment of family members.

Example. A non-working pensioner who has paid for his treatment cannot take advantage of the deduction, since pensions are not taxed. But his son/daughter can receive a deduction if he pays for the parent’s treatment. If the amount of expenses was 120,000 rubles, then the refund will be 15,600 rubles.

Conditions for receiving a deduction for payment of medical services

You can claim treatment expenses for deduction if (clause 3, clause 1, article 219 of the Tax Code of the Russian Federation):

— medical services are provided by a medical organization or individual entrepreneur who has a Russian license to carry out medical activities;

— the treatment was paid for by the taxpayer’s own funds, and not by the employer;

- the treatment is included in the established lists of medical services or expensive types of treatment. Both lists were approved by Decree of the Government of the Russian Federation of March 19, 2001 N 201;

Conditions for receiving a deduction for the purchase of medicines

The deduction can include expenses for the purchase of medications only if they are prescribed by a doctor (clause 3, clause 1, article 219 of the Tax Code of the Russian Federation).

If you have a prescription, as of January 1, 2019, you can receive a deduction for any medicine. Before this date, it was required that the drugs be named in a special list (clause 3, clause 1, article 219 of the Tax Code of the Russian Federation; List approved by Resolution No. 201).

Conditions for receiving a deduction for the payment of insurance premiums under a VHI agreement

The condition for including insurance premiums under a VHI agreement in the deduction is that the insurance organization with which this agreement is concluded has a license to conduct the relevant type of activity, which provides for payment exclusively for medical services. In addition, a medical organization or individual entrepreneur who provided medical services must also have a Russian license to carry out medical activities (paragraph 2, 5, paragraph 3, paragraph 1, article 219 of the Tax Code of the Russian Federation).

What can you get a refund for?

Deductions for treatment are possible only for those types of medical services and medications that are contained in special Lists (Resolution of the Government of the Russian Federation No. 201 of March 19, 2001).

For example, a deduction can be obtained if the taxpayer incurred expenses for:

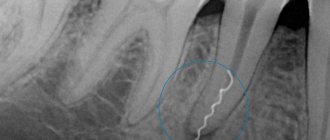

— examinations (ultrasound, medical tests, x-rays, fluorography);

— appointments with doctors (pediatrician, therapist, surgeon, ophthalmologist, endocrinologist, ENT specialist, gynecologist, etc.);

— dental treatment and prosthetics (including whitening, braces, veneers, crowns, dental implantation);

— treatment in hospitals, incl. in daytime;

— payment for staying in a paid ward;

— medical examinations;

— medical rehabilitation;

— treatment, diagnostics in a sanatorium;

— surgical treatment (malformations, diseases of the respiratory system, circulatory system, nervous system, digestion, malignant neoplasms);

— joint operations (endoprosthetics);

— implantation of prostheses, pacemakers, metal structures;

— plastic surgeries, incl. plastic surgery of the eyelid, lips, nose, ears, chest, abdomen, skin tightening, liposuction, etc.;

- abortion;

- treatment of diabetes mellitus;

— pregnancy management, paid childbirth;

— infertility treatment, IVF, ICSI, etc.

How to calculate tax refund for treatment

In order to determine the amount of the tax deduction, you need to understand that the law distinguishes two types of treatment: ordinary and expensive.

Conventional treatment . This includes almost any honey. services not only in clinics, but also in sanatorium-resort institutions.

Deductions for routine treatment, purchase of medications and contributions under a VHI agreement can be used in the amount of actual expenses, but within the limit of 120,000 rubles. per calendar year.

Example

A.A. Ivanov paid for his own treatment in the amount of 90,000 rubles in 2022. and medicines in the amount of 35,000 rubles.

The total cost of treatment and medications is 125,000 rubles. It exceeds the maximum amount of social deduction. Therefore, A.A. Ivanov has the right to receive a deduction in the amount of 120,000 rubles by submitting a tax return for 2022 to the tax office.

The amount of excess expenses over the maximum deduction amount (RUB 5,000) cannot be declared as a deduction either in the declaration for 2022 or in the declarations for subsequent years.

Expensive treatment. In particular, this includes implantation of dentures, endoprosthetics, infertility treatment using in vitro fertilization, cesarean section, rhinoplasty, blepharoplasty, abdominoplasty, otoplasty, mammoplasty, labiaplasty, etc.

The tax deduction for expensive treatment, unlike regular treatment, is not limited to a maximum amount. You can claim a refund of 13% of all expenses incurred.

The question of classifying certain types of services as expensive or conventional treatment is decided by honey. clinic.

A complete list of types of treatment is given in the Lists of medical services and expensive types of treatment approved by Decree of the Government of the Russian Federation of March 19, 2001 N 201.

The unused balance of the deduction cannot be carried over to the next year.

Example: In 2022, A.I. Sviridov went to a paid dental clinic and spent: 125 thousand rubles. for dental treatment and 320 thousand rubles. for implantation of dentures. Sviridov’s salary for 2022 amounted to 800 thousand rubles. Of these, 104 thousand personal income tax rubles were paid to the budget. What is the amount of tax deduction for treatment entitled to Sviridov? Since dental treatment is not an expensive type, Sviridov will be able to claim a maximum amount of 120 thousand rubles for deduction. But denture implantation is on the list of expensive treatments. Therefore, you can receive a deduction for the entire cost of implantation. Thus, the total deduction amount will be 440 thousand rubles. (120 thousand rubles (dental treatment) 320 thousand rubles (implantation). The amount of tax refund will be 57.2 thousand rubles (440 thousand rubles × 13%). Since this amount is less than the personal income tax paid for 2022 , then in 2022 Sviridov can immediately receive a refund for the entire amount.

What is the most profitable way to return a refund to your family?

Despite the restrictions on the amount of tax deduction established by the Tax Code of the Russian Federation, the amount of tax refund can be increased. This can be done if the tax deduction amount is distributed among family members.

For example, if one spouse paid for the treatment of the other, then either of them can receive a deduction, since the expenses were paid from their common funds (property acquired jointly during the marriage). And both can receive it by distributing between themselves the amount of expenses for deduction. So, for example, if a spouse paid for her treatment in the amount of 200 thousand rubles, then she can claim a deduction in the amount of 120 thousand rubles, and her husband can claim the remaining amount of 80 thousand rubles.

You can also distribute the deduction for treatment between parents and adult children.

Example: Mom spent 800,000 thousand rubles on implants, but the official salary per year is only 500,000 thousand rubles, respectively, mom can return only 500,000 * 13% = 65,000 rubles. Since the mother cannot return the deduction of 300,000 rubles, but her daughter’s salary allows it, you can submit a declaration for your daughter and return 39,000 rubles.

However, in this case, it is necessary to pay special attention to the correct execution of documents, so we recommend that you contact tax experts.

Other deductions that are included in the social deduction

The maximum amount of social tax deduction is 120,000 rubles. set in aggregate for social tax deductions:

- for your own education, as well as the education of your brothers and sisters;

- for your own treatment, as well as the treatment of your spouse, parents, children and wards;

- for non-state pension provision and voluntary pension insurance, voluntary life insurance (under contracts for a period of at least five years) in one’s own favor or in favor of a spouse, parents or children;

- to pay additional insurance contributions for a funded pension;

- to undergo an independent assessment of their qualifications.

That is, this amount (120,000 rubles) is common for all types of social deductions (with the exception of expenses for the education of children and expensive treatment).

If during one calendar year a citizen has incurred expenses on several grounds and the total amount of expenses exceeds 120,000 rubles, then the deduction is provided in the maximum possible amount (120,000 rubles), and the excess amount is not carried over to subsequent tax periods. In this case, the citizen must independently determine what amounts of expenses he intends to declare as tax deductions (in an amount not exceeding 120,000 rubles).

Example: Taxable income of A.I. Petrov for 2022 amounted to 500,000 rubles, personal income tax was paid in the amount of 65,000 rubles. (RUB 500,000 × 13%). In 2022, Petrov: paid for an appointment with a general practitioner in the amount of 10,000 rubles; bought medications prescribed by a doctor, included in the List, in the amount of 20,000 rubles; made contributions under a voluntary health insurance policy issued in favor of his wife - 15,000 rubles; paid for my training in the amount of 80,000 rubles. and child education in the amount of 45,000 rubles; paid for my brother’s treatment - 25,000 rubles. What amount of tax deduction for treatment is he entitled to? The law does not provide for a deduction for his brother’s treatment; therefore, Petrov cannot claim it. For other expenses the amount was 125,000 rubles. (10,000 20,000 15,000 80,000). Thus, the amount of expenses exceeded the social deduction limit of 120,000 rubles. Petrov has the right to return personal income tax from a maximum amount of 120,000 rubles, that is, 15,600 rubles. (RUB 120,000 × 13%). Expenses for the child's education did not exceed the established subclause. 2 p. 1 art. 219 of the Tax Code of the Russian Federation, the limit is 50 thousand rubles. Thus, a citizen can take advantage of a deduction for a child’s education and return from the personal income tax budget an amount of 45,000 rubles, that is, 5,850 rubles. (RUB 45,000 × 13%). So, the amount of tax to be refunded from the budget was 21,450 rubles. (15,600 5,850). It does not exceed the amount of personal income tax paid (RUB 65,000), which means it is subject to a full refund.

What documents are needed?

The list of documents for deduction depends on whose treatment you are paying for and for what types of expenses you want to receive a deduction.

Documents for deduction for medical payments. services

1. Agreement with a medical institution (IP) for the provision of medical services.

2. Certificate of payment for medical services for submission to the tax authorities.

During normal treatment, the “service code” line will contain the number “1”. For expensive treatment, the number “2” will appear in the “service code” line.

2.2.1. Certificate of materials purchased for expensive treatment.

If an endoprosthesis, an artificial valve, a lens, or an insulin pump were used during an expensive treatment, then the cost of these materials can also be attributed to the costs of expensive treatment. (Letters from the Federal Tax Service dated 07/18/2017 N BS-4-11/ [email protected] , dated 05/18/2011 N AS-4-3/ [email protected] ).

2.2.2. Payment documents for the purchase of medical materials for expensive treatment.

3. The stub of a sanatorium-resort voucher.

You will need it if you were treated or underwent rehabilitation at a sanatorium-resort institution. The bill must indicate the cost of medical services you paid (excluding room and board).

4. Documents confirming relationship (if you paid for the treatment of family members).

5. Additional documents - if the treatment was paid for by the employer, and then its cost was withheld from the salary.

Documents for deductions for medicines

1. Original doctor's prescription (according to form N 107-1/у).

This recipe is special, it must be stamped “For the tax authorities of the Russian Federation, Taxpayer INN.” It is certified by the doctor’s signature, his personal seal and the seal of the medical organization. This prescription is written in two copies: one for the pharmacy, and the other for submission to the Federal Tax Service.

2. Documents confirming payment for medications.

3. Documents confirming relationship (when paying for medications for family members).

Documents for insurance deduction (VHI)

1. Voluntary health insurance agreement concluded with an insurance company.

2. Documents confirming payment of insurance premiums for VHI.

3. Documents confirming relationship (if necessary).

4. Additional documents if the employer paid for the insurance and then withheld its cost from the salary.

How to apply for a refund

At the end of the calendar year in which you incurred expenses for treatment, a social deduction may be provided by the tax office. In particular, you have the right to apply to the tax authority for the balance of the deduction if the employer was unable to provide it to you in full (paragraph 1, 5, paragraph 2, article 219 of the Tax Code of the Russian Federation).

The tax authority, within three months from the date you submit your declaration and supporting documents, conducts a desk audit, and within another month, the amount of the overpayment is subject to refund if the deduction is confirmed (clause 6 of Article 78 of the Tax Code of the Russian Federation).

We suggest that you do not waste time on paperwork and communication with the tax office. The “Return Tax” service will help you return the maximum amount of tax quickly and easily!

Experienced experts will study your situation, prepare all the necessary documents and send them to the tax office. In case of exceeding the tax refund period, refusal to provide a deduction or underestimation of the payment amount, we ourselves will draw up appeals and complaints about the actions (inaction) of tax officials.

The process of obtaining a deduction for treatment

The process of obtaining a deduction for treatment consists of collecting and submitting documents to the tax office, checking the documents by the tax office and transferring money. You can learn more about the process of obtaining a tax deduction, indicating the deadlines, here: The process of obtaining a tax deduction for treatment.

The process of obtaining a deduction can be simplified by using our service. We will fill out the 3-NDFL declaration for you, tell you what other documents you will need for the deduction, and also give detailed instructions on submitting documents to the tax authorities. Or we will send your documents ourselves, without your participation. If you have any questions while working with the service, tax experts will be happy to advise you.

What documents are needed to receive an income tax refund for treatment?

Declaration 3-NDFL, application for deduction, certificate of income 2-NDFL, passport - with this set of documents any person who decides to exercise his right to receive a refund of personal income tax from the amounts spent on treatment will need to start processing the deduction.

IMPORTANT! The possibility of a tax deduction for treatment expenses is provided for in subparagraph. 3 p. 1 art. 219 of the Tax Code of the Russian Federation.

To ensure that collecting documents for a tax deduction for treatment does not turn into a waste of time, you first need to check whether all legally established conditions and restrictions associated with the use of a social deduction are met, clarifying the following points:

- The person who paid the medical expenses and received the medical service is the same person or the indicated persons are close relatives.

IMPORTANT! Close relatives are considered to be parents, spouses and children under the age of 18 (including adopted children and wards). See also “You can receive social benefits if the person ordering the treatment is your spouse.”

- The person who paid the medical expenses and the deductible claimant are the same person.

IMPORTANT! If the treatment was paid for by the company, the tax authorities will refuse the deduction.

- The taxpayer claiming the deduction has income taxed at a rate of 13% and paid personal income tax to the budget.

IMPORTANT! Pensioners or individual entrepreneurs using the simplified tax system and UTII will be able to claim a deduction only if they have income taxed at a rate of 13%.

If the above conditions are met, you can safely begin collecting the following documents to deduct personal income tax for treatment (this will be discussed below).

You can familiarize yourself with the procedure for filling out the 3-NDFL declaration in the article “Sample of filling out the 3-NDFL tax return” .

Sign up for a free trial access to K+ and get full information about the procedure for receiving a new social deduction for fitness starting in 2022.

Documents required to apply for a tax deduction for treatment

To apply for a tax deduction, you will first need:

- declaration 3-NDFL;

- agreement with a medical institution;

- certificate of payment for medical services;

- documents confirming your expenses;

- documents confirming the paid income tax (certificate 2-NDFL).

You can view the full list of documents here: Documents for tax deductions for treatment.

Procedure for registering a deduction

- You need to collect the necessary package of documents and submit them to the INFS.

- The tax authority reviews and verifies documents (the law allows up to 3 months for this).

- After the audit is completed within ten days, the taxpayer receives a notification about the results of the procedure.

- If the decision is positive, the applicant will receive a money transfer within 1 month.

Package of documents for tax deduction for treatment

If copies of documents are submitted, it is recommended to have the originals with you so that tax officials can certify them. The following documents are required, prepared in accordance with the requirements:

- 3-personal income tax declaration;

- certificate from the accounting department about actual annual income (form 2-NDFL);

- ID card (original and copy of passport);

- an application requesting a deduction, which specifies the details for crediting funds;

- a certificate from a medical institution (sanatorium) confirming payment for treatment;

- license of the medical institution or sanatorium where the treatment was carried out;

- payment documents confirming payment for services or medicines (checks, strict reporting forms).

FOR YOUR INFORMATION! The list of required documents also includes an agreement for the provision of medical services, concluded by the taxpayer or his close relative with the medical institution. But, if you don’t have it on hand, if you have all the other documents, the refusal to deduct will be unlawful - the letter of the Ministry of Finance No. 03-04-05/10-1239 dated November 1, 2912 explains that its presence is not necessary.

When and for what period can I receive a tax deduction?

You can get your money back for treatment only for those years in which you paid directly. However, you can submit a declaration and return the money through the tax office only in the year following the year of payment or later. That is, if you paid for treatment in 2022, you will be able to return the money no earlier than 2022.

If you did not file a deduction immediately, you can do it later, but you can return the tax for no more than the last three years. For example, if you paid for treatment in 2016-2020 and did not receive a tax deduction, then in 2022 you can get your tax back only for 2022, 2022 and 2022.

The entire procedure for obtaining a deduction usually takes three to four months. Most of the time is spent checking documents by the tax office.

Note: from January 1, 2016, a social tax deduction for treatment can be obtained through an employer, and there is no need to wait until the end of the calendar year. You can find details about receiving a deduction through an employer in our article: Obtaining a tax deduction for treatment through an employer.

What expenses are paid by the state?

In general terms, the Tax Code of the Russian Federation establishes the following types of expenses, which are accepted as a deduction for personal income tax:

- medical services of health care institutions;

- services provided by individual entrepreneurs engaged in medical activities;

- the cost of medications that were prescribed to a citizen by the attending physician and purchased by him with his own money.

The list of services is determined by Government Decree No. 201 dated March 19, 2001 and includes:

- emergency medical care;

- outpatient services;

- inpatient care;

- Spa treatment;

- health education.

For more specific types of medical services, see Section Q of the All-Russian Classification of Products by Type of Economic Activity.

The same Resolution 201 previously determined the list of medicines, the purchase of which also provides the right to a refund of paid personal income tax. It became invalid due to the publication of a government act. It is worth assuming that any drug prescribed by a doctor and purchased with your own funds is subject to the deduction rule.

Since for expensive types of treatment there is a special rule regarding the acceptance of all expenses as a deduction, this act of the Government also defines this list.

These types of treatment in medical organizations include:

- various types of surgical treatment of severe forms of diseases;

- joint prosthetics and operations to restore them;

- transplantation;

- treatment of severe forms of certain diseases;

- combined treatment of cancer, diabetes, hereditary diseases, etc.;

- treatment of burns of at least 30% of the body;

- hemodialysis;

- nursing premature babies up to 1.5 kg;

- in vitro fertilization.

Reference! In total, the list contains 27 items, the last of which (IVF) was introduced by a separate act already in 2007.

List of medical services for which a tax deduction is provided

According to Decree of the Government of the Russian Federation No. 201 of March 19, 2001, the following medical services can be taken into account in tax deductions:

- Diagnostic and treatment services when providing emergency medical care to the population.

- Services for diagnosis, prevention, treatment and medical rehabilitation in the provision of outpatient medical care to the population (including in day hospitals and by general (family) practitioners), including medical examination.

- Services for diagnosis, prevention, treatment and medical rehabilitation when providing inpatient medical care to the population (including in day hospitals), including medical examination.

- Services for diagnosis, prevention, treatment and medical rehabilitation when providing medical care to the population in sanatorium and resort institutions.

- Health education services provided to the public.

How much can you return?

Recently, the procedure for reimbursement of costs for paid medical services has been simplified. It is legally established that the following amounts are subject to refund:

- 13% of the maximum tax base of 120,000 rubles when using standard services;

- 13% of the total cost of treatment upon entry.

Example

If the cost of medical procedures is 160 thousand rubles, only 15,600 rubles will be reimbursed (since the maximum base for calculating the tax deduction is 120,000 rubles).

Important! Treatment deductions can be received annually. The balance of uncollected funds is not carried over to the next year.

List of expensive types of treatment for which a tax deduction is provided

According to Decree of the Government of the Russian Federation No. 201 of March 19, 2001, the following medical services are expensive and are taken into account in the tax deduction in full (without a limit of 120 thousand rubles) :

- Surgical treatment of congenital anomalies (developmental defects).

- Surgical treatment of severe forms of circulatory system diseases, including operations using artificial blood circulation machines, laser technologies and coronary angiography.

- Surgical treatment of severe forms of respiratory diseases.

- Surgical treatment of severe forms of diseases and combined pathologies of the eye and its appendages, including the use of endolaser technologies.

- Surgical treatment of severe forms of nervous system diseases, including microneurosurgical and endovasal interventions.

- Surgical treatment of complicated forms of diseases of the digestive system.

- Endoprosthetics and reconstructive operations on joints.

- Transplantation of organs (complex of organs), tissues and bone marrow.

- Replantation, implantation of prostheses, metal structures, pacemakers and electrodes.

- Reconstructive, plastic and reconstructive plastic surgeries.

- Therapeutic treatment of chromosomal disorders and hereditary diseases.

- Therapeutic treatment of malignant neoplasms of the thyroid gland and other endocrine glands, including the use of proton therapy.

- Therapeutic treatment of acute inflammatory polyneuropathies and complications of myasthenia gravis.

- Therapeutic treatment of systemic connective tissue lesions.

- Therapeutic treatment of severe forms of diseases of the circulatory, respiratory and digestive organs in children.

- Combined treatment of pancreatic diseases.

- Combined treatment of malignant neoplasms.

- Combined treatment of hereditary bleeding disorders and aplastic anemia.

- Combined treatment of osteomyelitis.

- Combined treatment of conditions associated with complicated pregnancy, childbirth and the postpartum period.

- Combined treatment of complicated forms of diabetes mellitus.

- Combined treatment of hereditary diseases.

- Combined treatment of severe forms of diseases and combined pathologies of the eye and its adnexa.

- Complex treatment of burns with a body surface area of 30 percent or more.

- Types of treatment associated with the use of hemo- and peritoneal dialysis.

- Nursing premature babies weighing up to 1.5 kg.

- Treatment of infertility using in vitro fertilization, cultivation and intrauterine embryo insertion.

Examples of personal income tax returns

You can return money for treatment either according to the general procedure, with tax calculated from a maximum base of 120,000 rubles, or for expensive services, for which the tax is refunded from the full cost of services. An exhaustive list of medical services classified as expensive has been approved by the Tax Inspectorate. Such procedures include IVF, complex operations to correct congenital pathologies, treatment of genetic diseases, cancer, severe forms of diseases of various organs and systems, surgical operations, nursing premature babies born weighing less than 1.5 kg, etc. With the current list, you can check out the official website of the Federal Tax Service.

Important! The certificate issued by the medical institution indicates a code that classifies the services received as inexpensive (code 1) or expensive (code 2).

Tax refund for dental prosthetics

Pensioners often receive a tax deduction for dental prosthetics, since the problem is very pressing for them. Whether dental services from a dentist fall into the category of expensive treatment is a controversial issue. The Ministry of Health in its list included some types of dental treatment and implantation of prostheses in this category, but the Federal Tax Service believes that such services cannot be considered expensive and did not include them in its comprehensive list of services. In practice, even if the medical certificate indicates code 2, the Federal Tax Service often refuses to pay a deduction from the full cost of expenses.

Example

Citizen P. P. Sobolev, being a non-working pensioner, had prosthetic teeth and spent 180,000 rubles on dental treatment. At the clinic where he received services, the certificate was given code 2. Since an unemployed pensioner himself cannot claim a deduction, his son handled the registration. He submitted an application to the tax service for a refund of 23,400 rubles. But the inspectorate refused and approved the amount of only 15,600 rubles as a social deduction.

Tax refund for sanatorium treatment

When you are in a sanatorium-resort area, you must remember that the costs directly include treatment services and expenses for purchasing medications. Expenses such as travel, accommodation, personal spending on leisure and food are not taken into account.

Important! A trip to a sanatorium purchased from a travel agency that has the appropriate license is regarded as confirmation of payment of expenses.

Example

In 2016, my daughter purchased a ticket to a sanatorium for mineral waters for non-working pensioner R. S. Akaeva, since her mother often complained of stomach problems. The cost was 70,000 rubles for 20 days, payment was made via the Internet. During examinations, the pensioner was diagnosed with an allergic reaction that needed urgent treatment. The doctor prescribed Quifenadine. The cost of two packages was 600 rubles. In 2022, my daughter filed a tax deduction and returned the amount of 3,900 rubles. The fact is that accommodation, food and travel are not included in expenses. Before leaving, the pensioner took a certificate from a medical institution, which indicated the amount of medical procedures worth 30,000 rubles, and also saved the doctor’s prescription and received a copy of the license. However, she lost the receipt for the purchase of medicine. A certificate, license and voucher were presented to the tax authority, on the basis of which the amount of the deduction amounted to 3,900 rubles.

Tax refund for the purchase of medicines

A non-working pensioner, if he has the right to a tax refund or through his children, can return part of the money spent on the purchase of medicines. The main condition is that the drug belongs to the established list, a prescription from a doctor and receipts confirming payment.

Example

Lonely citizen G. A. Baryshev spends 3,700 rubles on medicines every month. Of this, 3,200 rubles are spent on medications included in the Federal Tax Service register. A significant amount is spent per year - 44,400 rubles. A pensioner lives in his own apartment, receives a pension and officially rents out a room in a hostel for 7,000 rubles a month. The annual tax amount is 10,920 rubles. He has the right to return the deduction in accordance with the procedure established by law. To calculate the tax due to Baryshev, we take the amount of 38,400 rubles. (3200*12 months). Deduction – 4992 rubles. Since the personal income tax amount is larger, he can return the deduction amount annually, compensating for part of his costs.

Example of a refund for sanatorium treatment

Let's look at the size of the deduction and the amount of compensation due using a specific example:

Citizen Ivanov, being a pensioner, continues his work and has a salary of 360,000 rubles in 2022. From this amount, the employer transferred personal income tax for him (let’s assume that standard tax deductions were not applied) 360,000 * 13% = 46,800 rubles.

In the same year, citizen Ivanov had some health problems, and he was forced to agree to a paid operation (let’s assume that it is not part of an expensive type of treatment) costing 100,000 rubles. After the operation, the attending physician prescribed Ivanov sanatorium treatment for 3 weeks at a cost of 40,000 rubles.

According to the law, for 2022, Ivanov can use a tax deduction in the amount of expenses actually incurred, but not more than 120,000 rubles. So, he can claim a full deduction for the operation and a deduction of 20,000 for sanatorium treatment (or 80 and 40 thousand, which is not important). Accordingly, the refund of overpaid personal income tax will be 120,000 * 13% = 15,600 rubles. Since the income tax he paid exceeds this amount, he will receive it in full.

It is also useful to read: Registration of a free trip to a sanatorium for a pensioner